Can your company grow on recurring income if your payments are not safe?

No! Although people long for comfort, they do not want to risk their bank account and personal data.

The subscription economy is growing rapidly and the key reason for this growth is comfort. Since OTT streaming and playing games to listening to songs and receiving food sets, models based on subscriptions revolutionized customer interactions and payments.

But making payments is still a risk! Do you remember that fitness applications, restore and the unused application? These are accurate cyber criminal Optorununity, which was supposed to create and steal sensitive data.

Since they receive an average of 17 paid media subscription subscriptions for the millennium, concerns about cyber security increase and become a primary factor for long -term business success. In this blog paper we will look at the role of the signature economy and cyber security in it.

Understanding an economy of subscription

The subscription economy is a business model in which customers move from traditional one -off purchases to repeating payments for access to the product or service after a preliminary period. It can be for a weekend, a month, six months or even a year.

The deadline concerns the Broade market towards trading models based on subscription. Signature -based economic characteristics are:

- Repetitive income: Businesses rely on reworking payments, generally monthly or annually. A fixed number of users make payments, leading to predictable and robust income flows. You can even predict future financial needs and specify business strategies.

- Temporary approach: Signature -based customers are not interested in ownership of the product; They just want a time approach to fulfill their needs. Subscription models offer flexibility to suspend a subscription at the moment.

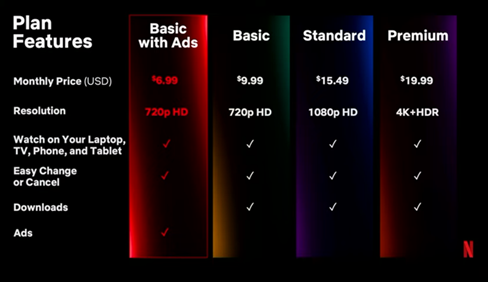

For example, Netflix is working on a subscription -based model. It receives recurring payments from users and in return allows access to streaming services for a limited period of time.

Source

- Adaptation: Customers accept traditional products as they are without getting the opportunity to adapt them. But in the subject’s models, you can customize your package by including the necessary services and tools.

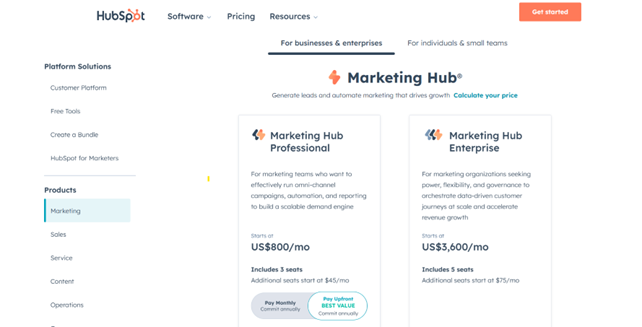

For example, Hubspot, Saas, offers its users adapted plans to access marketing software. Offered two plans:

- Marketing Hub Professional: for small marketing teams.

- Enterprise Hub Marketing: For large marketing organizations.

Based on the size of your business, select the plan and apply the benefits.

Source

- Customer satisfaction: Customers re -involvement after purchase are time -consuming and unproductive. Sincere material supplements work on regular payments and providing immediate services, customers feel satisfied and determined, which supports confidence.

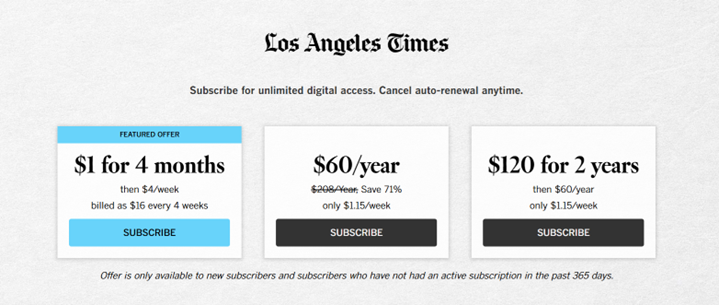

For example, a news website such as The Los Angeles Times has offered a digital approach based on the subject to the latest news and updates. The site even warns users of message violations, keeps them up to date and connected.

Source

Speaking of these digital platforms, one thing raises concerns – the threats of cyber security and the impact on the payment gateway. We will understand the connection between cyber security and signature.

Cyber Security: Hidden backbone subscriptions

The subscription economy is expected to reach USD 34851 billion with $ 59.5%by 2029. With this rapid growth, the model becomes prone to cyber security threads and warns business to take preventive steps.

Even customers prefer to make payments and share personal data with platforms that have a protective layer to secure data. Therefore, effective cyber security is not only pleasant; It is an irreplaceable factor for building trust and credibility.

There are three pillars of cyber security:

Preparation

- Elaboration of a robust plan of response to incident

- Protocols to ensure clear communication in case of violation

- Regular audits and threat evaluation

Organization

- Employment to verify two factors across platforms

- Introduction Role based on access control (RBAC)

- Strict security policies with frequent evaluation

Awareness

- Organization of Safety Training Programs

- Performing phishing exercises

- Well -defined safety panties

Regulation business is not only about the validity of the monitoring plan. Cyber security protocols should be considered to avoid fraud and customer confidence. Let’s explore why the cyber security of the spine of the regulation trade is:

1. Shared access weakens verification

Access to multiple users opens a window for cyber criminals. For example, if a friend, a colleague or a member of the family with whom you shared access to phishing fraud may endanger sensitive data such as banking data and authorization of all users associated with this particular account.

A common scenario is when team leaders share Slack Access team leaders with multiple team members without proper authentication.

Source

Solution: Deployment of one login (SSO), two -factor verification (2FA) and multi -factor verification (MFA) to strengthen access control. You can also employ professional time monitoring software to monitor user activity and detect unauthorized access.

2. Risking payment data

No matter what subscription customers they take, they must share their payment details with your platform. In the case of cyber attack, payment data of all users are at risk. If the customer uses the same payment method on multiple platforms, then the only break can show all their financial information.

Solution: Offer payment such as virtual credit cards, wallets and alternative payment methods (APMS) to create a bridge between the bank account and the platform. You also have to.

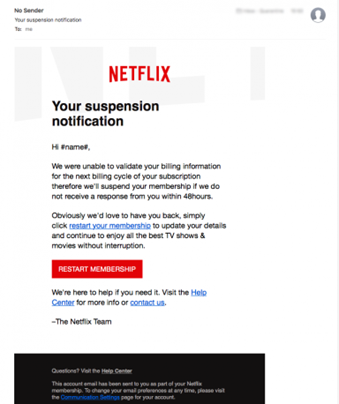

3. Subscription fraud

A notorious cyber attack tactic is to send false alerts of the recovery and notification of an account suspension via phishing e -mails. These e -Mails carry links to fake websites imitating the original service. Users are cheating on sensitive banking data, which provides full access to their bank accounts.

Source

According to a survey conducted by cyber security experts, on average, 31,000 phishing attacks take place on an average of the formal business e -mails.

Solution: Book users about fake links and use E -Mail filtering tools to detect phishing messages. You can also use AI-POWER monitoring to send regular account updates to the user.

4. Unused subcies invites cybernetic criminals

Forgot to subscribe to a streaming account is fine, but not deactivation is a problem. Cybernetic attackers in a lever account to access logged data and digital fraud. A common tactic is the encirclement of credentials, where attackers collect data on leakage of login data from historical violations to log in to multiple platforms.

A sleeping account is an easy target because they have weak passwords and are not monitored. According to the OKTA state of Secure Identity 2022, 34% of the account for prey for stuffing on their platform races.

Solution: Use the subspECRInt management tools to monitor unused accounts and cancel regulations. Depending on minimizing the risk of safety disruption, maintain less sleeping.

5. Unauthorized registration

A team member can apply for a prepaid CRM tool without approval. This scenario is a term like Shadow IT, which hits the chances of cyber attacks and harms compliance. Shadow IT offers direct access to malware and errors to stole vital client data.

Shadow IT Infreed at 56% in SaaS industry, because companies usually use about 270-364 applications to master different tasks.

Source

Solution: Tools for managing a cloud lever to centralize account management and allow IT experts to strengthen security protocols. Also, the detection of fraud with AI-LED can identify suspicious registrations and block access.

Challenge of Payment Complexity in subscription model

Although subscription models generate stable and recurring income flows, along the way they also represent the challenges of payment complexity.

Some common challenges in the subscription model included:

1. Consistency with regulation

To ensure data protection, run a business model based on the signature of strict adherence to GDPR and PCI DSS regulations. For example, if you run a technique, compliance with multiple legal requirements becomes a mandate for scale around the world.

Failure to comply often leads to a hefty fine of up to $ 100,000 per month (for non -compliance with PCI DSS).

2. Maintaining the customer

In recurring income models, maintaining customers is the most important part because income has returned. This includes investing Surfoy in custom -made content to customers and a transparent payment process.

Factors such as unclear price, Unique Price Respan and unsuccessful bucket reduce customer satisfaction and increase the excess of the outflow. Therefore, a user -friendly billing process and a self -service portal need to improve customers.

3. Strong payment servers

Businesses must work with reliable payment servers to minimize failed payment scenarios. To develop strategies for solving expired credit cards, insufficient funds and server bankruptcy. These strategies could include automated reminders, repetitions of payments and multiple payment options.

For example, Saas can integrate into international transaction gates to minimize the decline in payments.

4. Store data

In order to collect recurring payments, businesses are stored by banking data of their customers for smooth transactions. However, the challenge is the storage of sensitive data. Data on violations may lead to substantial monetary loss and legal sanctions.

Payment information is the most anticipated data for committing fraud and sales on a dark site.

Simplified and Secure Integration payment systems

Introduction The Secure Payment Systems (SPS) is essential for every subscription -based business model. SPS provides secure transaction lines in cloud spaces that guarantee safe payments, alleviate fraud and payment failure.

Key elements include:

- Stagnation

- Chip

- Payment gateway

- Mfa

- Digital wallet

- PCI DSS Compliance

The combination of all these elements prevents fraud and offers a satisfactory user experience. With people who resorted to online payments and digital products or services, the integration of simplified SPS has become critical. Let’s understand this with an example:

Amazon, front online retail store, tokenization implements into its process. For example, when you make a transaction with Amazon Payment Services, it generates a token containing your card information. This ensures that the card data is not stored on servers.

Video

Now, whenever you return, just enter the three -digit security code and complete the token. Amazon also used this token to process recurring monthly payments and ensure that the sensitive information about the card is never stored on the web.

Therefore, payment risks are minimized and the returned currents are interrupted.

Secure your payments for sustainable subscription growth

The growing degree of adoption of trading models based on subscription requires trouble -free payment experience. This is possible if business goes beyond comfort and focus on building trust and credibility.

Customers are predicted to participate in platforms that offer undeniable cyber security. Cyber security increases customer confidence and shares sensitive data without any problems. From ensuring payments to maintaining customers, cyber security is a pillar that supports the economy of the regulation.

Do you want to work with a trusted payment gateway?

Visit 2Checkout.com today and maximize your back to anywhere in the world.

About the author

Vineet Gupta

Vineet is the founder of 2xSAS, digital PR and construction agencies focused on results that work with brands like Hubspot, Hunter, G2 and more. He specializes in creating his own foreign campaigns and strategies of content marketing that helps B2B and SAAS to improve their ecological operation.